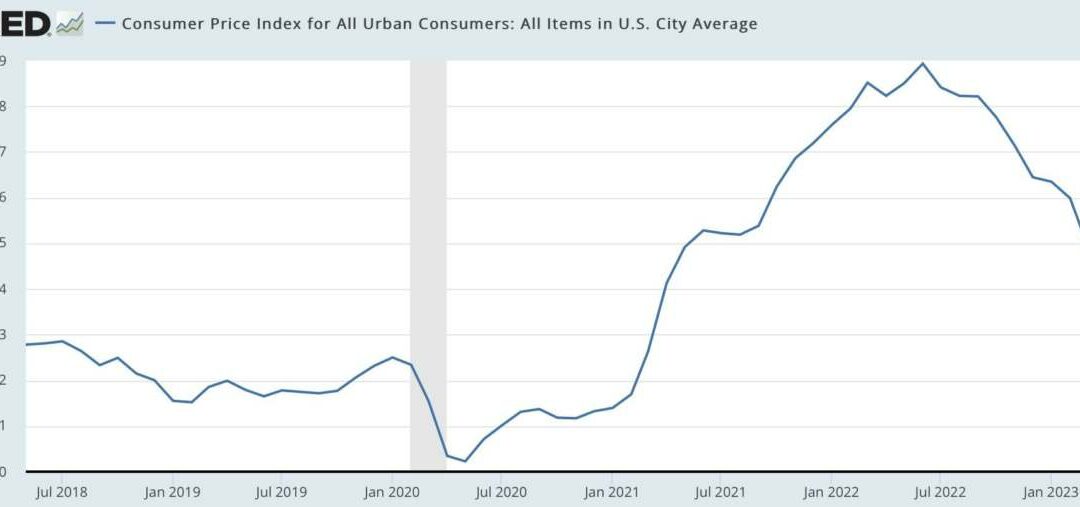

Retirement Savings: How Much Should You Save For A Comfortable Retirement Life?

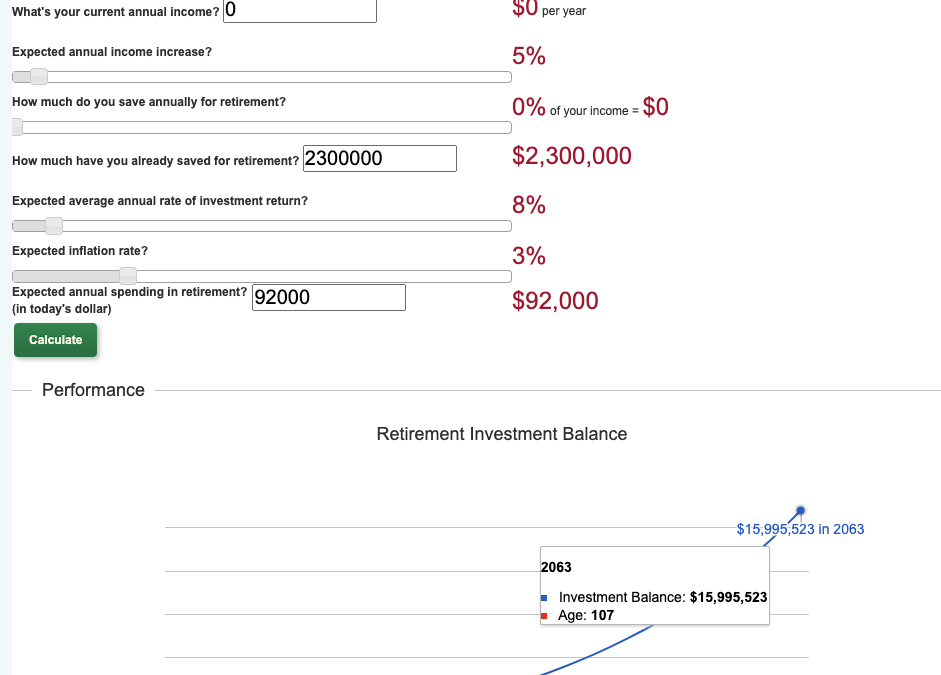

High yield bonds, managed correctly, can be a valuable addition to boost fixed income returns.

High yield bonds, managed correctly, can be a valuable addition to boost fixed income returns.

High yield bonds, managed correctly, can be a valuable addition to boost fixed income returns.

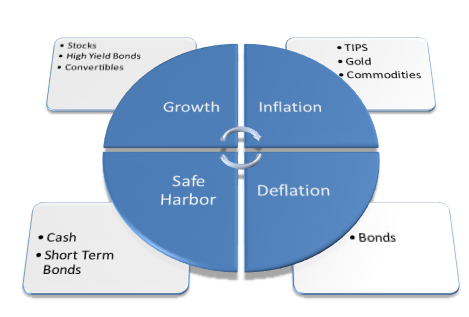

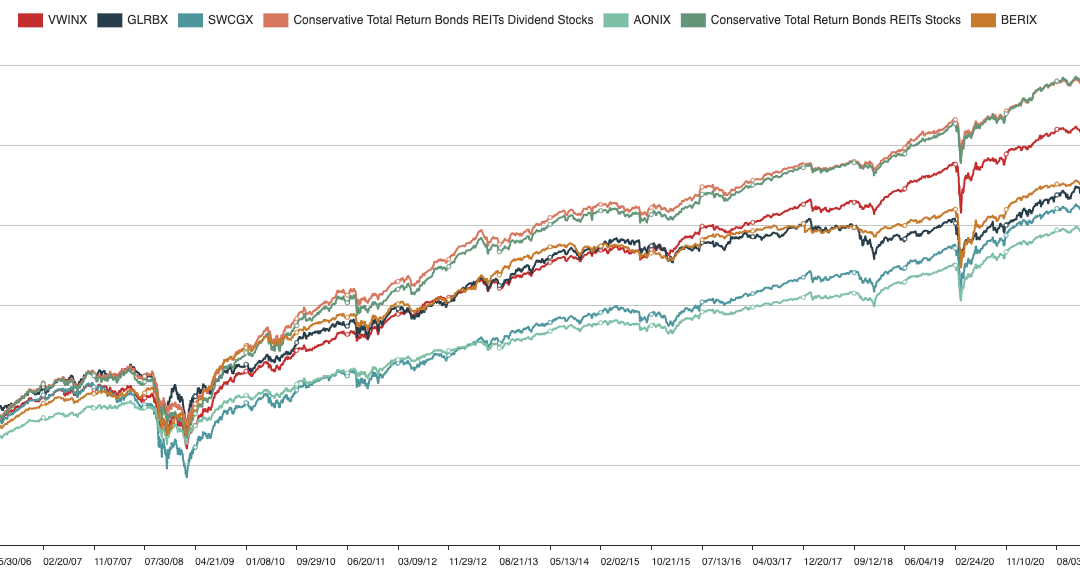

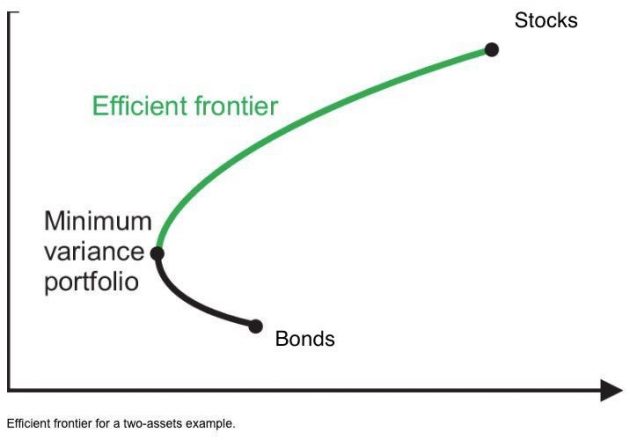

We look at several famous lazy portfolios and discuss asset allocations and diversification effect in portfolio construction.

We look at several famous lazy portfolios and discuss asset allocations and diversification effect in portfolio construction.

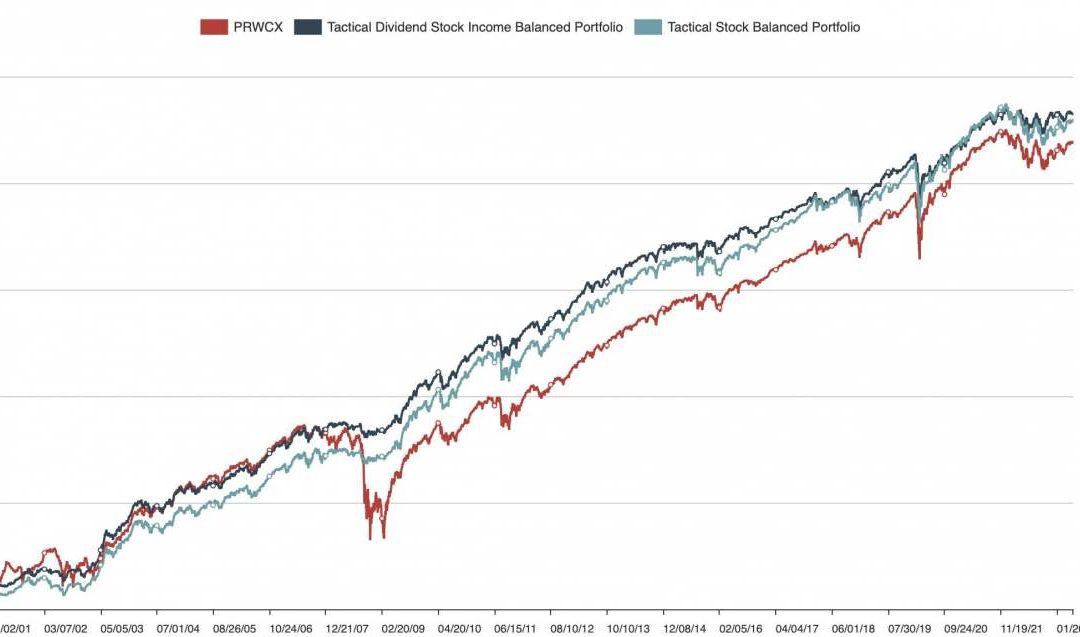

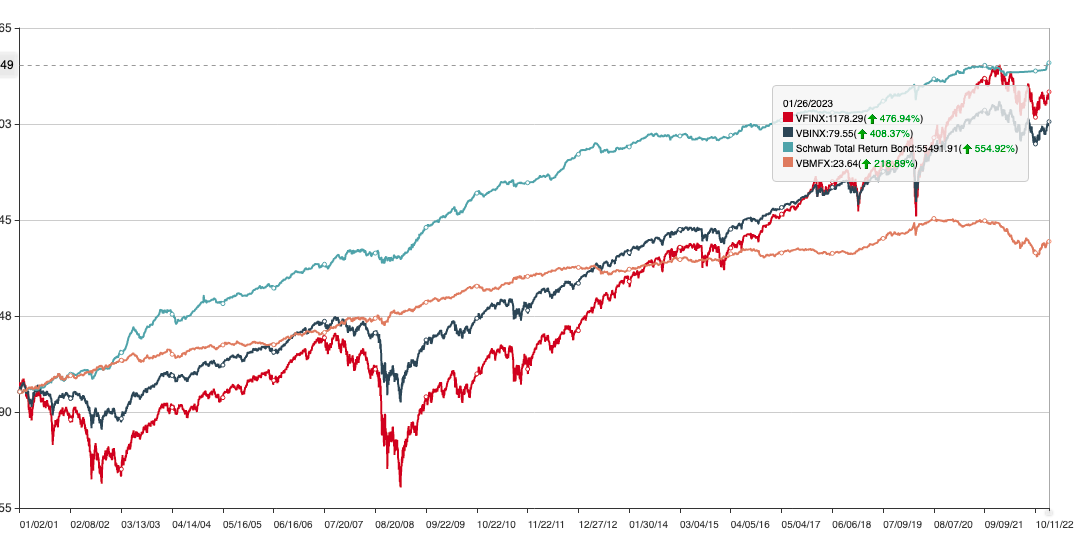

We present our tactical balanced stock and dividend income portfolios that outperform the best balanced allocation fund T. Rowe Price capital appreciation fund PRWCX both in terms of returns and risk

We take a business investing approach to invest in solid low cost stock index funds such as S&P 500 index funds. We discuss why it’s beneficial to view index fund investments as ‘conglomerate’ business investments.

We take a business investing approach to invest in solid low cost stock index funds such as S&P 500 index funds. We discuss why it’s beneficial to view index fund investments as ‘conglomerate’ business investments.

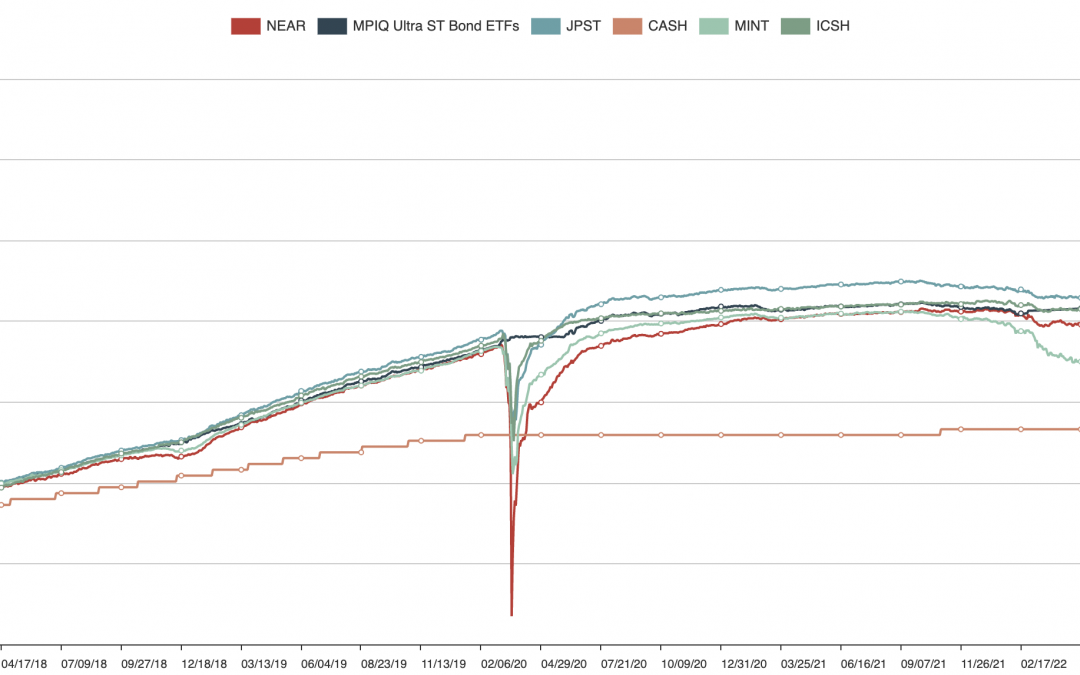

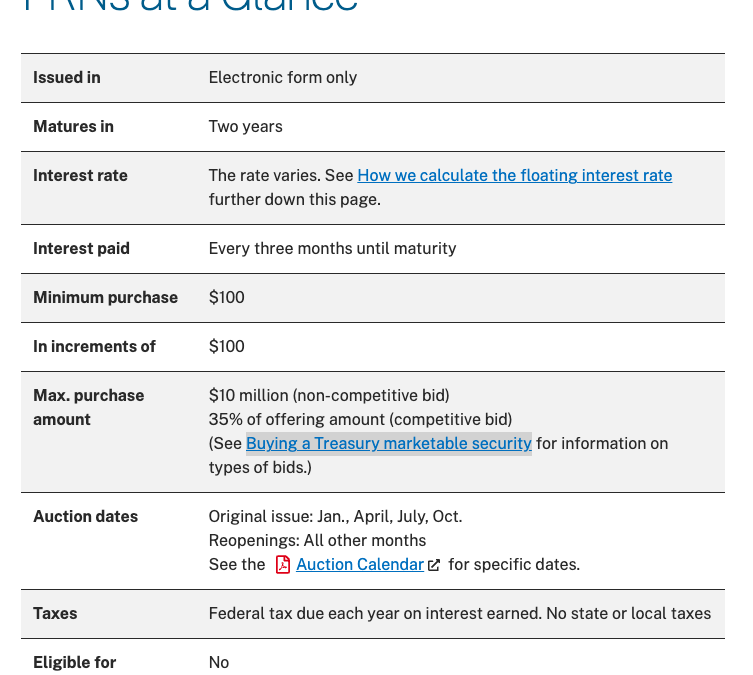

We survey some ultra short term bond ETFs that can be used as Cash or money market substitutes.

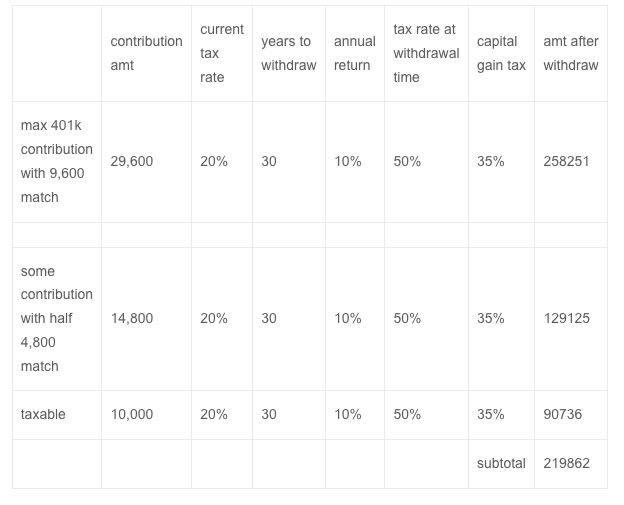

We encourage maximizing 401k match and discuss some details on 401k contributions and match.

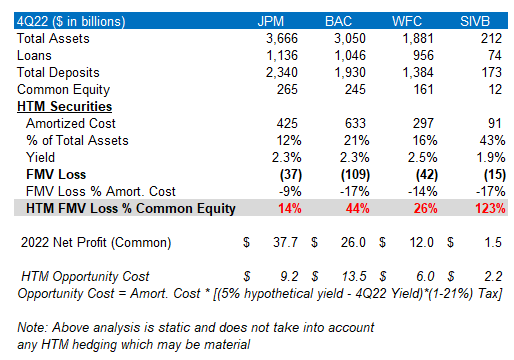

Bank On My Own! Avoid Banks as middle men and get much higher and safer returns! In this newsletter, we describe what happened for Silicon Valley Bank failure and propose a better way to bank: on your own.

We look at ETFs from Dimensional Funds Advisor and Capital Group and discuss whether they are suitable for asset allocation portfolios.

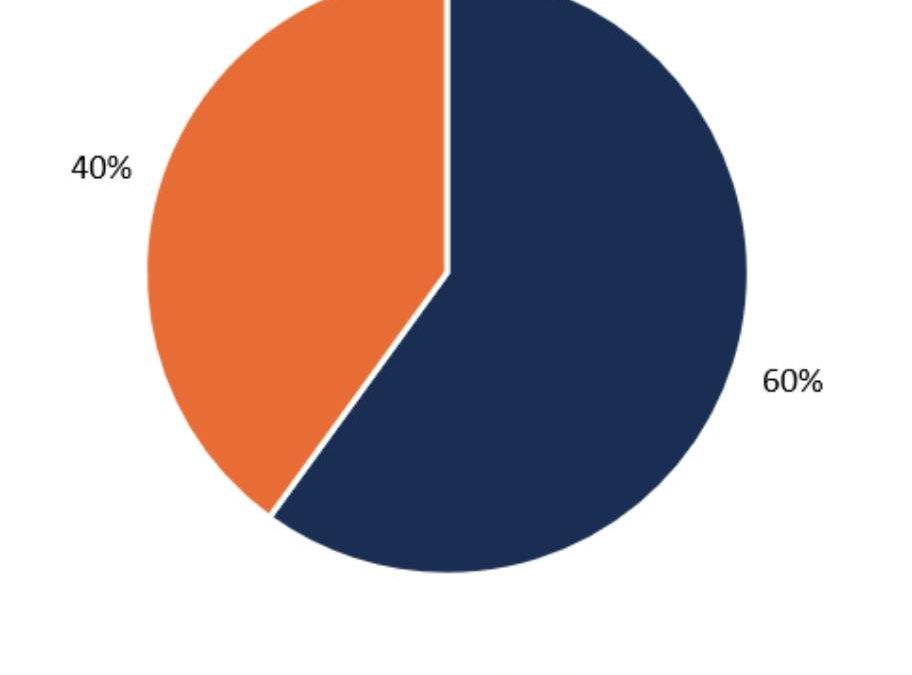

We point out that a conservative allocation portfolio could be very effective for many types of investors.

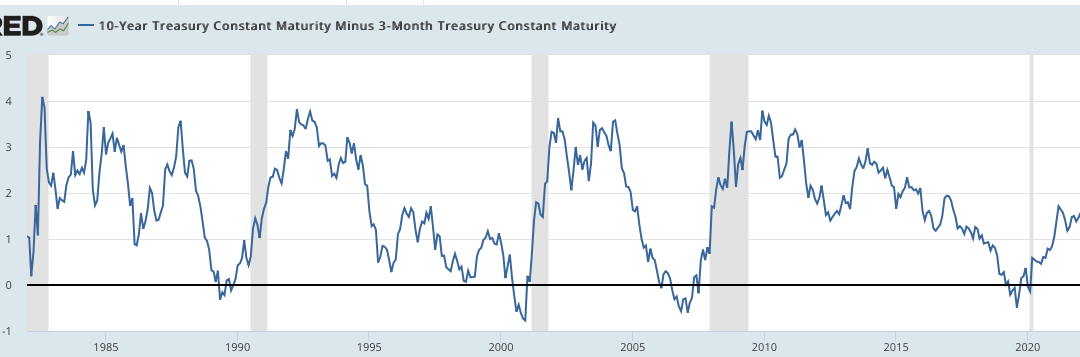

We have another in-depth look at fixed income (bonds) in the current environment.

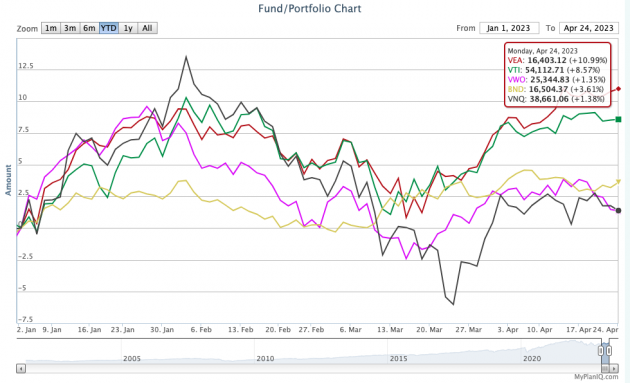

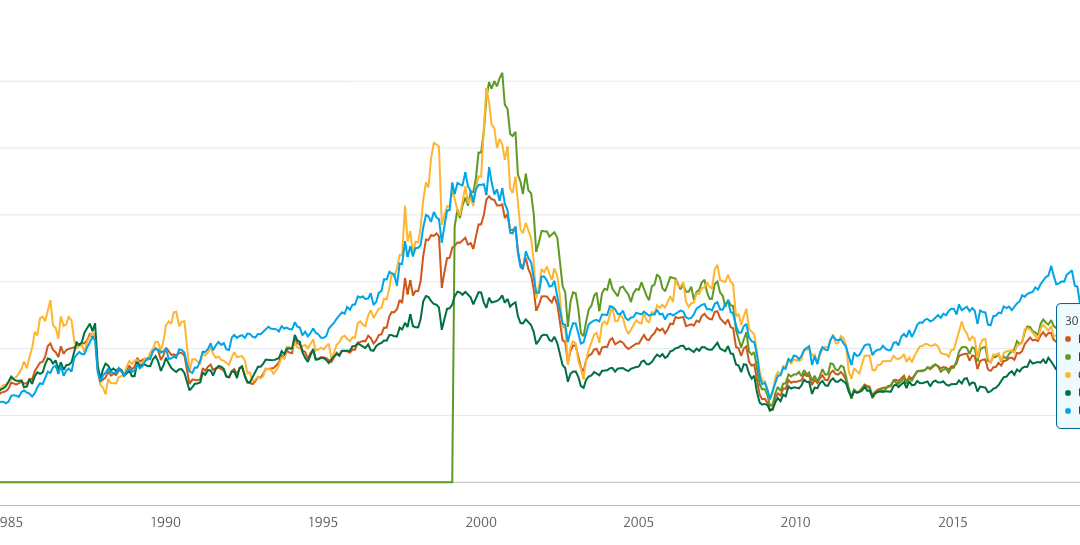

Developed country and emerging market stocks have positive tailwind that supports its secular relative strength.

We review our portfolios for last year and discuss this year’s outlook

We summarize newsletters written in the past months.

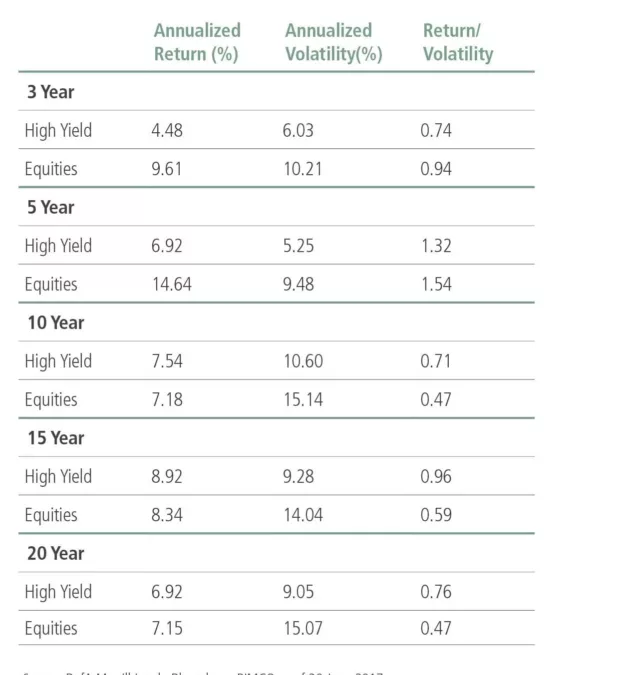

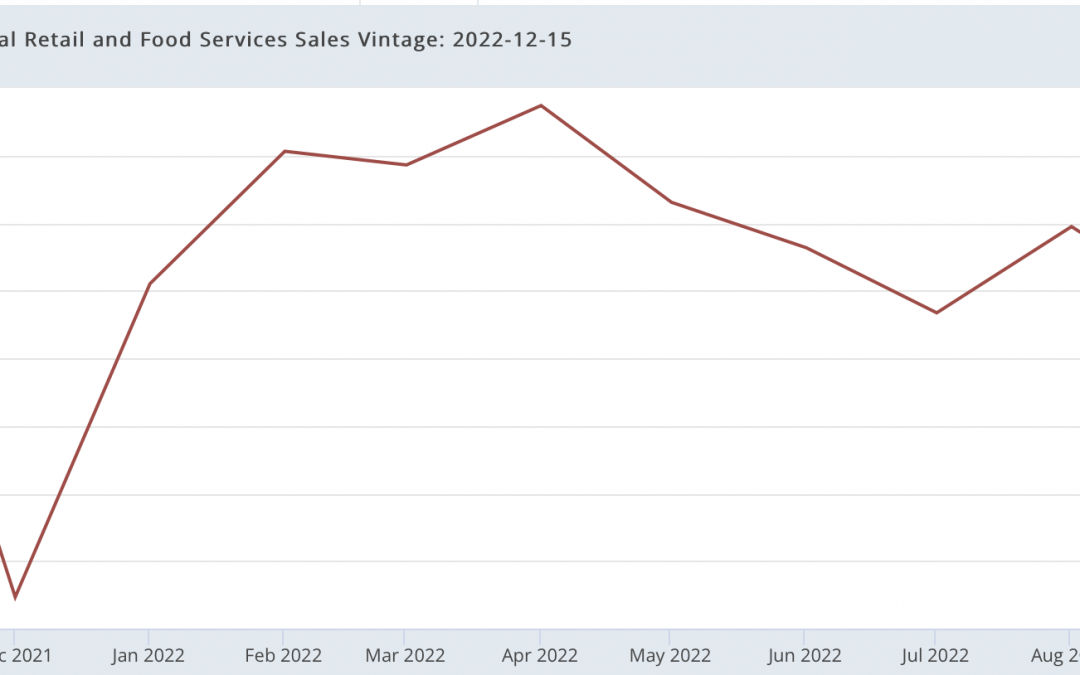

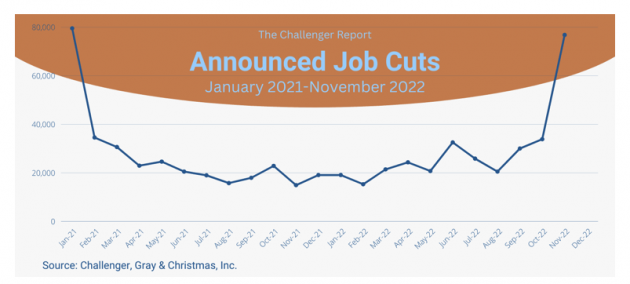

We review the latest market and economy trends and discuss several scenarios including recession and soft landing.

We discuss several cash substitutes, in particular, we look at floating rate Treasury ETFs as cash substitutes

Our fixed income portfolios’ excellent outperformance continues. We also review the current bond markets

Itchy to buy stocks as they have come down a lot? You might want to consider an excellent ‘business’ stock: S&P 500 index fund.