IRAs as One of the Emergency Fund Sources

n this issue:

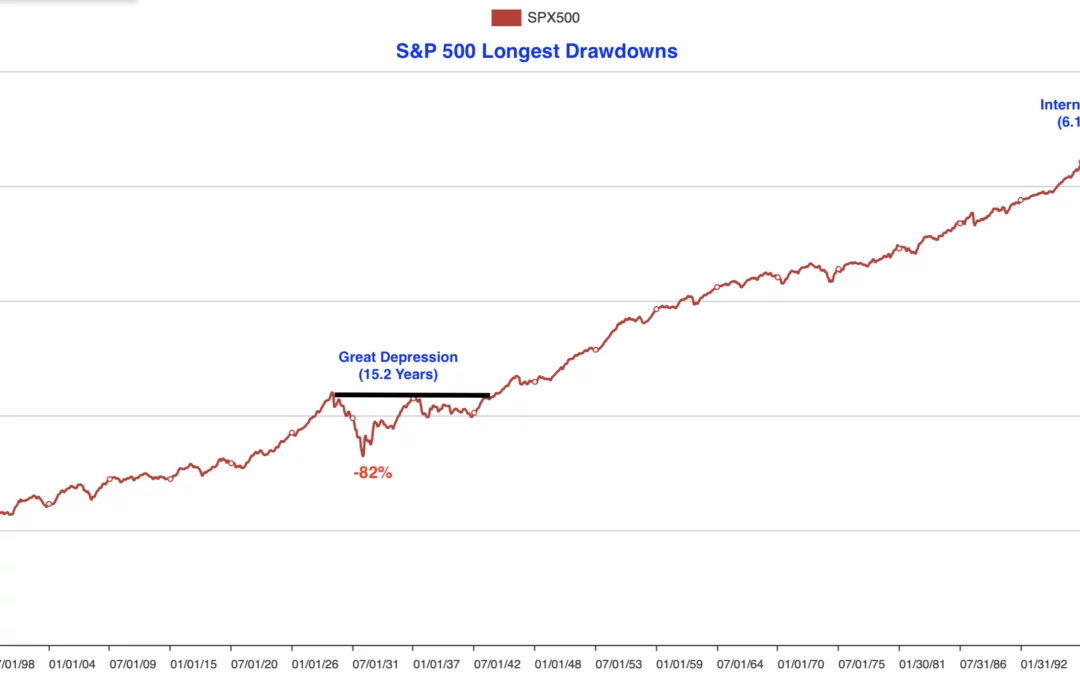

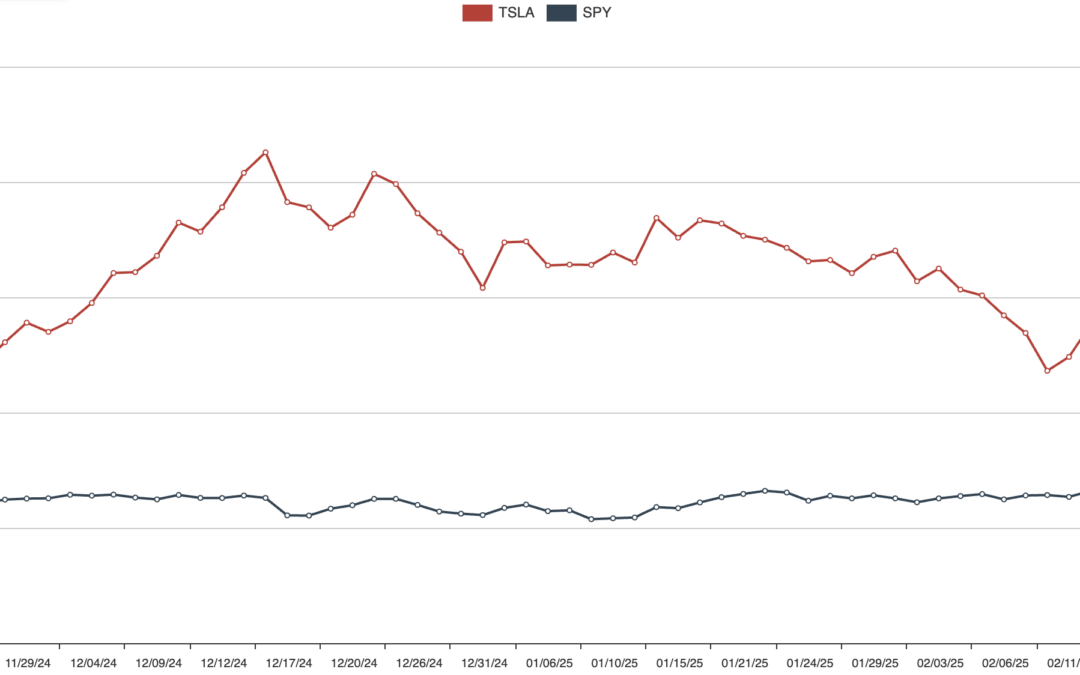

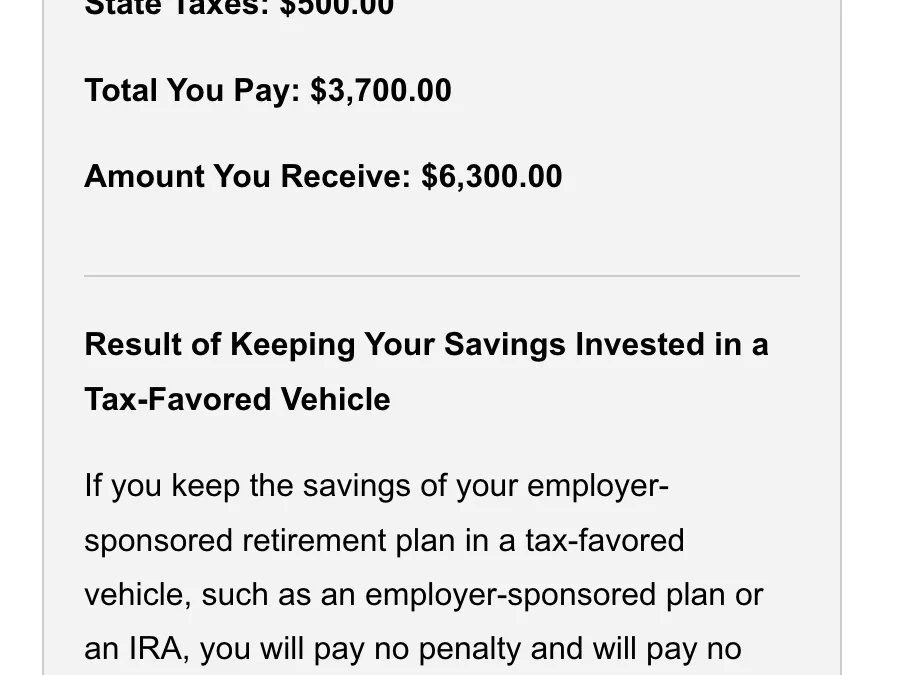

- Latest in Retirement Savings & Personal Finance: Back-and-forth Tariff Policies, Stock Market Swings, and Low Retirement Savings Rates

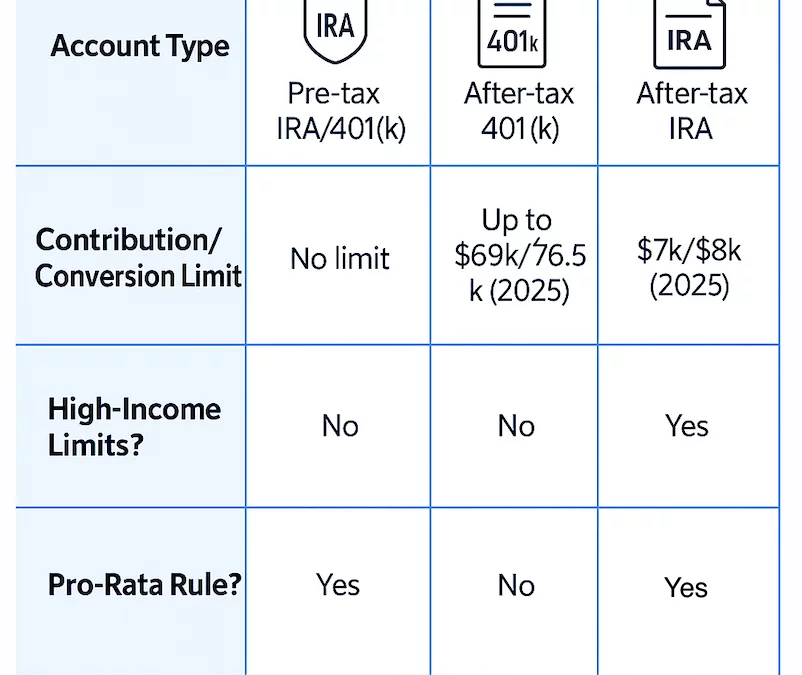

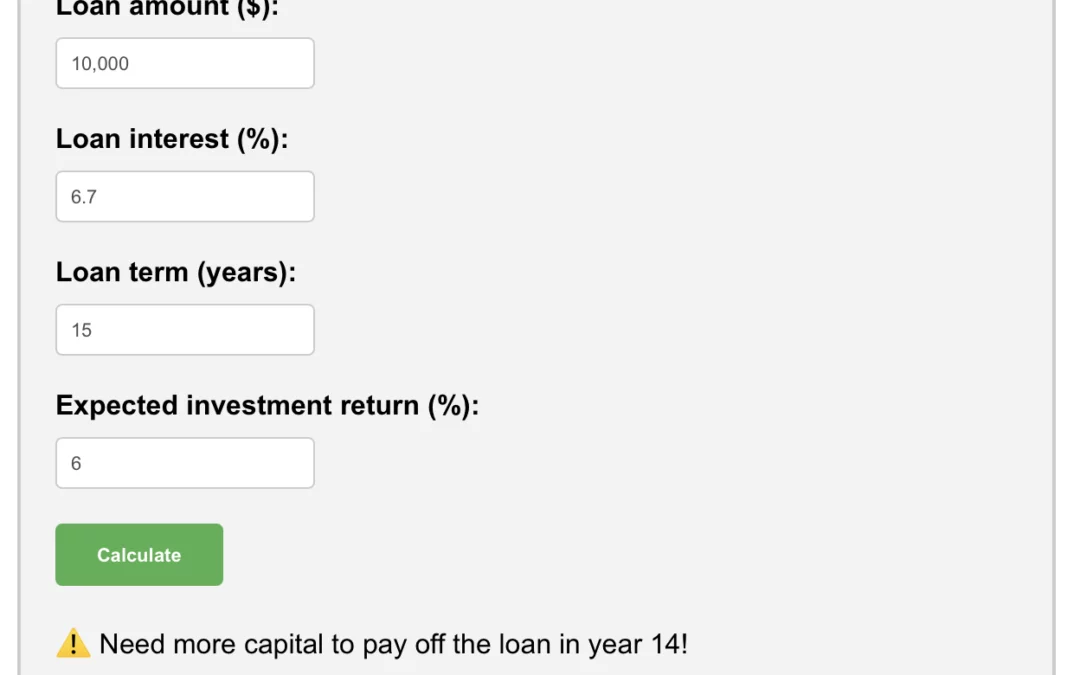

- IRAs as One of the Emergency Fund Sources

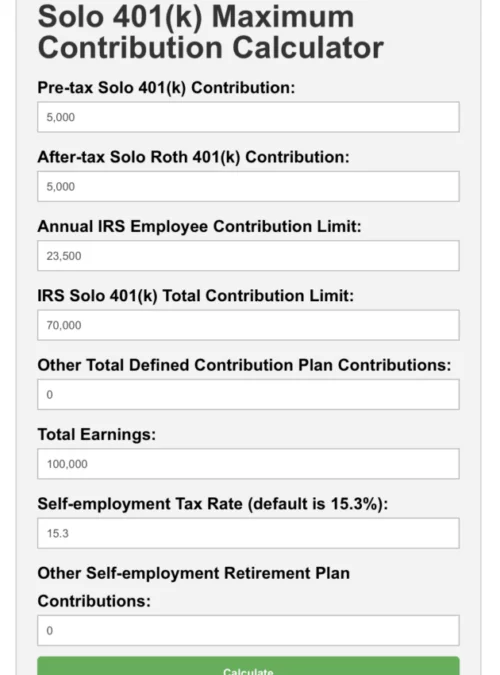

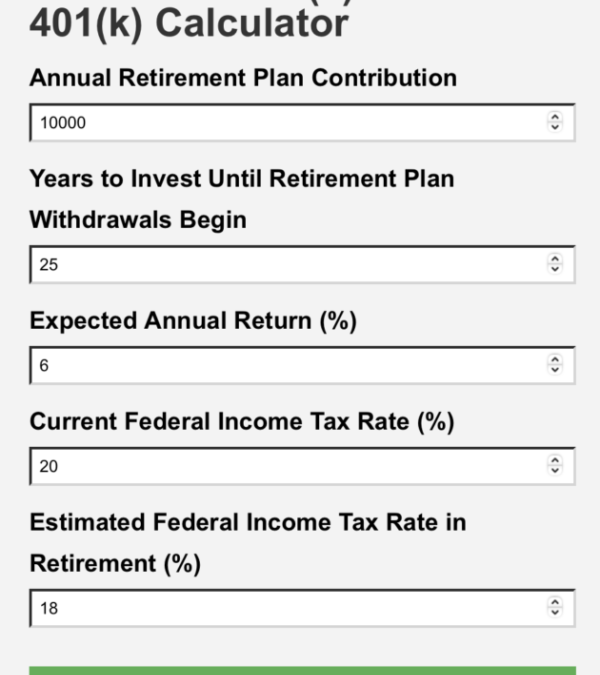

- The Gotcha in Maximum Solo 401(k) or SEP IRA Contribution Limits

- Market Overview